Outsourcing vs. Automation: Optimizing ROI in Invoice to Pay Processes

Insights on Risks and their Remediation within an Outsourced Invoice to Pay Process

Every day, the business world is getting more competitive, and successful organizations continually look for ways to improve services, reduce costs, and expand on their competitive edge. One area that has a high potential for improvement and optimization is the AP department. The more a company grows, the more challenging it can be for the AP department to keep up, creating a continual challenge to stay current with high-volume processes like Invoice to Pay. Hiring more staff adds additional expenses and staff management tasks, so many companies first turn to outsourcing as a way to address these bottlenecks while others take advantage of AP automation. Either can be an effective solution, but it’s important to consider all aspects of the issue-this is more than a simple shift in labor.

Automation Is Not Outsourcing

An important point to clarify is that automation and outsourcing are not the same thing. There is a degree of overlap and they can be used together in hybrid solutions, but there is a very important difference:

- Outsourcing – Paying another company to run your accounts payable department

- Automation – Using internal software to streamline your in-house AP system

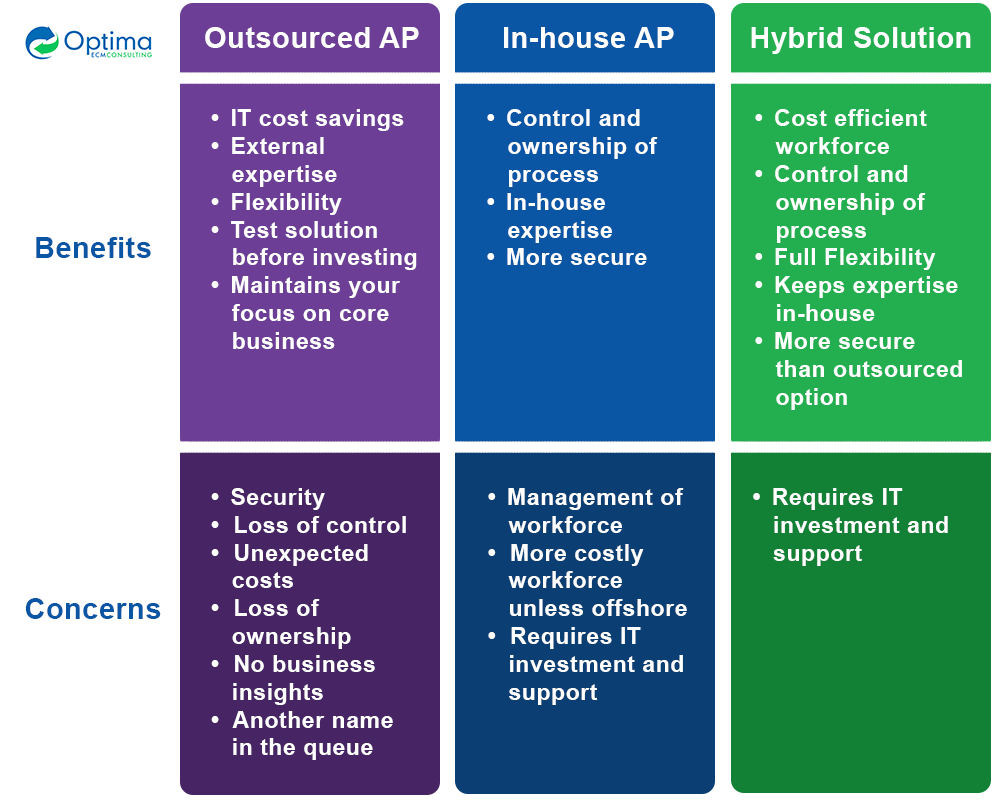

Each approach has benefits as well as their own unique drawbacks that must be considered before choosing which is best to solve AP challenges.

Not All Processes Should Be Outsourced

Under the right circumstances and when implemented correctly, outsourced Accounts Payable can provide tangible benefits and value to your business-especially for processes that are well-suited to the model. It can free up office staff from low-value administrative and technical tasks, and eliminate the internal time and resources required to find, interview, evaluate, and train new staff members. It can also allow a firm to quickly scale up or down depending on seasonal or success-based growth challenges.

Pros And Cons Of Outsourcing Invoice To Pay

When making the decision to outsource the operations of a company, there are some things to consider before making any decisions. Note that in this paper we’re focusing on the Invoice to Pay process as a critical subset of the entire Procure to Pay process in the Accounts Payable Department. Some of these issues are inherent to the outsourcing process, while others depend on the outsourcing partner and their level of skill.

Lack of Control

Obviously, when a 3rd party is in charge of all invoice-related processes, the company loses a degree of control. Every workflow is executed by the outsourcing partner without oversight by company staff. Companies need to consider how much insight and input they need, and be sure their partner can provide the level of information and detail they require.

General Business Risk

When outsourcing AP operations, the primary company will be dependent on the outsourcing partner’s policies and procedures for how they do business. If the outsourcing partner has staffing shortages, a security breach, or goes bankrupt, AP operations and prompt invoice payments can be at risk. This can dramatically impact general operations and may cause vendors take action for non-payment if it is not resolved quickly.

From an audit perspective, organizations that use outsourced partners have less compliance insight unless the system used by the partner and access requirements are defined explicitly in advance. Without controlling the users or what system and process to follow, it is difficult to identify issues within the process. This makes AP invoice management feel like an uncontrolled “black box” instead of an integral component of the business.

Dealing with Exceptions

While the AP team processes the majority of vendor invoices, there will be exceptions where an invoice cannot be posted and a resolution is required from outside the AP department. For example, discrepancies on purchase orders and missing deliveries will most likely need to be resolved in-house. In a fully outsourced invoice management solution, the workflow to manage communication to the occasional users from procurement or warehouse staff can be completely disconnected. These communications happen outside the system, and the control, documentation, and oversight are not captured and connected to the transaction record. The leading invoice management solutions on the market have built-in capabilities to manage these exceptions and rely less on procurement involvement. In the rare occasion that procurement needs to provide their final input, it should be an easy-to-use and traceable process, not a shift in workload over to the external buying/receiving team.

Another common exception to consider is duplicate invoices. Most outsourcing companies base their charges on the number of invoices they process per period, usually each month. If a company receives a lot of duplicate invoices, then there will be added cost for processing even though they ultimately will not get posted. Also, without the insights mentioned above, it can be challenging to monitor how many duplicate invoices are received and from which vendors. It is essential to have access to this information to identify problem vendors that may need additional guidance or training to work with the AP process efficiently.

The Hybrid Approach – Have Your Cake and Eat It, Too

Fortunately, there are Accounts Payable solutions for companies looking to reap the benefits of outsourcing-not having to train, hire, and manage an AP workforce-while maintaining the accessibility, control, and insights provided by fully in-house solutions. For these companies, a hybrid solution is a better approach and delivers the best of the other options. It is also one of the preferred strategies for companies striving to become an Intelligent Enterprise.

In a hybrid approach, the company implements their own invoice management solution in-house, which is then operated by an external workforce that manages and executes the day-to-day processing of all incoming invoices. This approach provides multiple benefits:

- Customized system aligned with business goals – With an in-house environment, the company can customize and streamline AP processes to match their unique business goals instead of having to adjust to an external partner’s requirements

- Full insights and reporting – AP Management has full access to processes, vendor, and invoice data, allowing for detailed insights into invoice lifecycles, process bottlenecks, and vendor compliance

- Opens additional capability – Full data visibility enables additional functionality like Dynamic Discounting and Supply Chain Financing that can improve and optimize working capital flows

- Secure data control – All sensitive data is stored and processed within the company IT infrastructure, ensuring access is managed by approved rules and oversight

- Control of digital transformation journey – An in-house system allows the AP environment to be integrated with the company’s larger digital transformation plans, and improved in line with their own long-term budget and goals

Conclusion

Both in-house and outsourced AP solutions have their benefits and pitfalls. To find the right solution, define your challenges, requirements, and priorities and select the one that best serves your short- and long-term business goals. For companies that need to reduce staff and related management and overhead, a completely outsourced solution may be the best approach. If the primary goal is to make things easier on the in-house AP department, then automation may be preferred. In our experience, companies can take advantage of the strengths of each approach to create a flexible hybrid solution that provides the capability and ROI they require while minimizing the day-to-day management and total cost of ownership of the environment.

RISE with SAP isn’t a new product, but instead combines the proven experience of SAP partners like Optima with successful strategies to migrate their business environments. Unlike traditional “rip and replace” schemes that shoehorn every business into a strict set of business workflows, RISE with SAP is designed to provide flexible solution options tailored to the functional, budgetary, and timeline requirements of individual companies.

Invoice Management Health Check

To help clients get the most from their system, we developed a unique Health Check as part of our proprietary Optima Accelerate™ methodology. This initiative is designed specifically to evaluate your VIM implementation’s unique configuration, integration, usage, and storage health. We then deliver a comprehensive report outlining current risks, required maintenance, and system improvements that would boost short- and long-term ROI. Finally, we can help you prioritize your needs and establish effective timelines and budgets to align your system with your business goals.

Learn More

For additional information on optimizing enterprise business solutions, check out these helpful resources: